SUN Senior Care is specifically designed to address the evolving life and health protection needs of your life stage, protecting your hard-earned savings even if an illness strikes.

Benefits of SUN Senior Care:

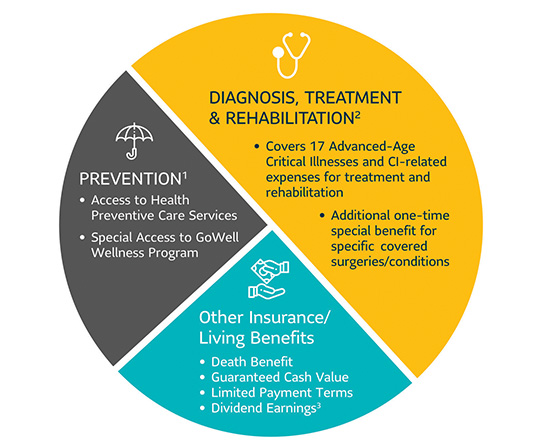

- Prevention1

Prevention is better than cure. With SUN Senior Care, you can be part of Sun Life’s wellness program, which offers preventive care services, health perks, and special privileges. - Diagnosis, treatment

and rehabilitation2

Coverage when you need it most. SUN Senior Care provides a significant financial benefit equal to 150% of the plan’s Face Amount, in case you are diagnosed with any of the seventeen (17) covered common advanced-age critical illness conditions. This will help replace the funds you spent on diagnostic investigations, as well as other expenses related to treatment and recovery. - Special benefit2

Ready and secured. SUN Senior Care provides an additional one-time cash benefit equal to 5% of the Face Amount to help ease the financial burden caused by any of the four (4) specific covered surgeries/conditions. - Life insurance protection3

Secure your loved ones' future while you are in the best of health! Assuming no critical illness benefit has been paid, SUN Senior Care guarantees life insurance protection equal to 150% of the plan’s Face Amount, until age 100.

- Limited payment period

SUN Senior Care may be paid in 3, 5, or 10 annual installments with a fixed amount throughout the chosen period. You may also opt to pay semi-annually, quarterly, or monthly.4 - Living benefits

Earn dividends5 from your plan which you may use to pay for future premiums, leave with Sun Life to accumulate, or receive in cash. In case of an emergency, your plan’s cash value is also available for a loan.

BENEFITS at a glance…

NOTE: Benefits indicated above are subject to the specific guidelines set by Sun Life and the actual provisions of the insurance policy contract. This product is subject to exclusions and/or provisions on pre-existing conditions and gives you the right to a cooling-off period, as stated in the insurance policy contract.

WHY DO FILIPINOS NEED THIS?

A lot of Filipino still don't know the concept of insurance and how it can help them, and there are a lot of people from the older generation who don't really think they don't need it because they get 'pension'.

But it's not enough.

Let's say you get 10,000 a month (and we have to stress that some people get an even smaller amount of cash incentive for their pension) and that you are living rent-free, for the food each meal cost 60Php per meal and we'll multiply that for 84 (3 meals x 7 days x 4 weeks) and that is already 5,400Php. And then we have to take into consideration the money spent on medications because having maintenance is inevitable and we know how expensive medicines are.

On my personal experience, my grandmother spends 1,500Php per week just for her medicines and also drinks milk worth 1,500Php per can which is good for only two weeks. So just imagine how average people suffer from great debts and sickness.

With SUN Senior Care, you're not just saving for your health but also saving to have a better life even in your golden years since you can enjoy a return of investment knowing that you will get dividends.

Want to know more about this product or avail of my FREE Financial Goals Planning for you? You may e-mail me at connect.teresa@gmail.com

With SUN Senior Care, you're not just saving for your health but also saving to have a better life even in your golden years since you can enjoy a return of investment knowing that you will get dividends.

Want to know more about this product or avail of my FREE Financial Goals Planning for you? You may e-mail me at connect.teresa@gmail.com

0 Comments